Business and economics, Issue 13/2024

Countries most vulnerable to the climate crisis are drowning in debt – who will help?

In June this year. The British Debt Justice organization has published an alarming report on the debt of the world’s 50 most climate-sensitive countries. It shows that the share of developing countries’ loan repayments in their GDP has not been this high since the 1990s. last century. While the consequences of climate change are staggering, poor societies are suffering doubly by not being able to invest in solutions that protect them from natural disasters. Can this situation be resolved somehow?

Countries most vulnerable to climate crisis

The Debt Justice report is based on a ranking compiled by the US-based University of Notre Dame, which ranks the world’s countries according to their vulnerability to climate change. The first five positions in it are occupied by Chad, Niger, Guinea-Bissau, Tonga and Sudan. The vast majority are African countries.

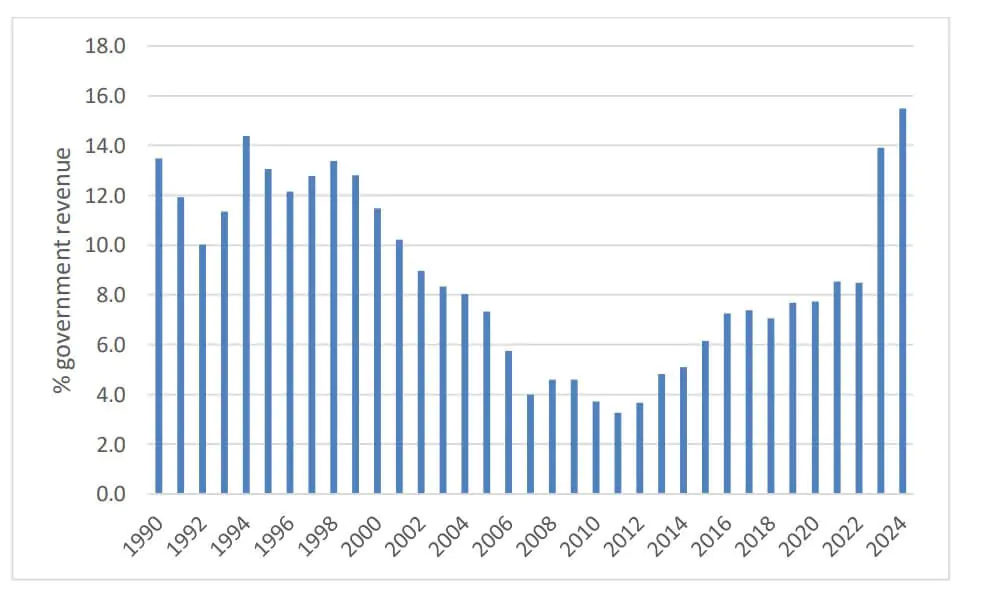

The ranking was compared with World Bank data on external debt repayments by country and the International Monetary Fund database. What did it turn out to be? In the 50 countries most threatened by the climate crisis, annual external debt obligations average 15.5 percent of national revenues. This is the highest level since 1990, four times higher than 2010. In Angola, debt repayment in 2024 reached 59.8 percent of national revenues, while in Sri Lanka, Zambia and Bhutan it reached 40 percent or more.

Source: Debt Justice, https://debtjustice.org.uk/

What is the reason for such a drastic increase in debt repayments?

Analysts at Debt Justice stress that the trends seen in the amount of external debt repayments reflect the global political situation. In the late 1990s. and in the middle of the first decade of the 21st century. there has been comprehensive debt relief for the world’s poorest countries, drastically reducing their budget burden.

Since 2010. Repayments began to rise again, reaching new heights after 2020. The reasons included a sharp rise in interest rates and the strengthening of the dollar, which is the main currency in international settlements. Temporary repayment suspension programs introduced at the beginning of the Covid-19 pandemic provided temporary relief, but liabilities are now rising again. The climate crisis is only making the situation worse, and each successive drought or flood further increases the already not inconsiderable budget burden. International aid programs still seem disproportionate to the needs.

China as largest global creditor

In the aforementioned group of 50 countries most vulnerable to the climate crisis, 38 percent. The cases creditors are private entities. Up to 30 percent. The debt is due to multilateral financial agreements, and 14 percent. are loans granted by China. According to U.S.-based AidData researchers, between 2000 and 2021, the Beijing-based government transferred $1.34 trillion to countries with low and medium GDP. In the form of grants and loans. It is now the largest bilateral lender in the world.

China’s policies have won it many allies in developing countries, but there is no shortage of criticism. Skeptics point out that, in many cases, generously supported infrastructure projects have plunged beneficiaries into debt that they are unable to shoulder. Examples include Sri Lanka and Zambia. November 2023. Britain’s The Guardian reported that in an effort to reduce financial risks, China has begun imposing greater penalties on debtors for late debt repayments. This means a further deepening of budget deficits in the world’s poorest countries.

Zambia’s climate crisis and debt restructuring

An example of a country that has found itself in a dramatic situation due to external debt is Zambia. This South African country with a population of 20 million citizens in 2023. owed foreign creditors $6.3 billion. – 2/3 of this is due to the Export-Import Bank of China. The government, in view of the difficult situation, managed to sign a historic debt restructuring agreement with private creditors. Representatives of Justice Debt, however, criticize its provisions.

According to the agreement, in the event of better economic conditions, the required installments may be automatically increased. However, the scenario of repayment reductions under pessimistic circumstances, such as the climate crisis, was not included. Zambia is thus expected to pay bondholders $450 million this year alone.

Meanwhile, the country has just experienced its driest season in 40 years. United Nations Office for the Coordination of Humanitarian Affairs. The UN Office for the Coordination of Humanitarian Affairs is sounding the alarm that significant agricultural crop losses, livestock losses and worsening poverty are expected. The drought is affecting 9 million people, of which 2 million citizens were already at risk of famine – their situation will get even worse. Of the 2.2 million hectares of corn planted nationwide, 982,000 were destroyed. ha. Citizens also have to contend with inconvenient power outages, as 95 percent of the The country’s energy comes from hydropower plants.

Instead of using domestic funds to help those affected by the drought, Zambia will have to put them toward debt. Collins Nzovu, Zambia’s environment minister, called on developed countries to help the poorer ones, pointing out that the blame for the climate crisis lies with the economic powers that fueled their growth decades ago by burning fossil fuels.

Bonn climate conference, or how to find a solution to the problem

On June 10 this year. The 10-day United Nations Climate Change Conference began in Bonn, Germany. During it, participants will consider how to finance the measures forced by the climate crisis, among others. in the context of the huge debt burden of countries that regularly experience droughts, floods and other natural disasters. Meanwhile, calls are already coming in from around the world for increased funding for adaptation and mitigation measures. In Europe alone, weather extremes cause losses of $15.5 billion each year. And it is not the Old Continent, but the countries of Africa, Asia and the small island states of Oceania that are highly vulnerable to the worsening climate crisis.

A report published in 2023 by an independent group of experts within the G20 indicates that “the world is on fire,” literally and figuratively, and that existing solutions and strategies are not enough to confront the global climate change crisis. Its authors point out that multilateral development banks (MDBs) must assume most of the responsibility for forming coalitions to respond effectively to the climate crisis. They have the potential to become a catalyst for domestic and private investment, as they have the necessary knowledge and financial resources, and understand how to responsibly manage risk.

As part of the New Delhi Declaration, G20 representatives pledged to significantly increase investments that implement the Sustainable Development Goals and the provisions of the 2015 Paris Agreement. As a result, experts are calling for:

- By 2030. Triple the amount of lending by multilateral development banks – to the tune of $390 billion;

- adopt a mandate committing to eradicating extreme poverty, boosting shared prosperity and contributing to the development of global public goods;

- expand and modernize financing models to broaden the investor base in innovative ways.

Will these generous declarations actually help solve the dramatic situation in Africa and other countries highly vulnerable to the climate crisis? There is no doubt that the next three decades will be a great test for global solidarity.

Polski

Polski